Why buy ReillyCoin.

We’re living in an economic environment and period of history that is unprecedented in monetary and fiscal policy. Central banks are experimenting with new monetary models under an element of duress due to the economic and health crisis that has plagued the world since 2008 & 2019 respectively. This experiment is engineered as central planning from within a centralised financial system orchestrated by global central banks and sovereign governments. Unfortunately it is an experiment there are no rule or text books to read through for answers to how this monetary policy experiment plays out. We know politicians and central bankers can get it wrong even in normal economic cycles and recessions, so what are the probabilities of them getting something wrong during a global economic and health crisis? You do the math.

Thankfully we now live in a digital age of smart contracts, cryptocurrencies and alternative digital assets that are stores of value which are all integral to the world of decentralised finance. Which democratises finance and allows the individual to take more responsibility for ones own financial future and freedom while mitigating and protecting oneself from the possibility of global central bankers and politicians getting it wrong. Welcome to decentralised finance, welcome to Reilly Coin.

Reilly Coin is a decentralised ECR-20 Smart contract run on the Ethereum blockchain ecosystem. Reilly Coin has a capped supply of tokens at 300 million, no more will ever be minted, protecting value in scarcity. Reilly Coin will have a Treasury Account which will hold a variable % of Reilly Coins supply and will also engage in buying up Reilly Coins from the market place to suit its mandate and strategy. Reilly Coin has a utility of purpose as a method of exchange and payment between peers., business to business. Our developers are working on a payment process that will allow businesses to accept Reilly Coin as a method of payment from customers. Our organisation believes in the blockchain network and the possibilities endless opportunities it presents to create many disruptive enterprises in decentralised finance and countless other areas of commerce.

Our organisation has analysed and researched that the current economic environment with excess liquidity and risk assets at all time highs, confirms there is a necessity and demand for new additional stores of value, especially digital decentralised ones, like Reilly Coin.

Let’s look at the rational argument for requiring a store of value in the current economic environment, together with what potentially is ahead via global monetary policy.

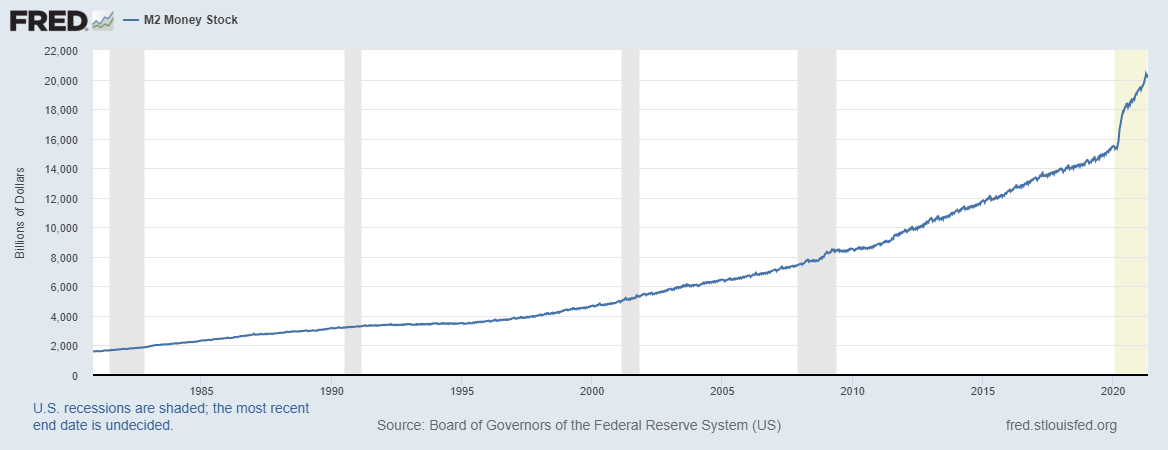

It’s only prudent to analyse the worlds largest economy and nation with the global reserve currency, the United States of America. Fundamental to the U.S centralised monetary experiment is quantitative easing (QE) which has created unprecedented levels of liquidity, credit and excess money supply (M2 includes cash, checking deposits, and easily convertible near money instruments).

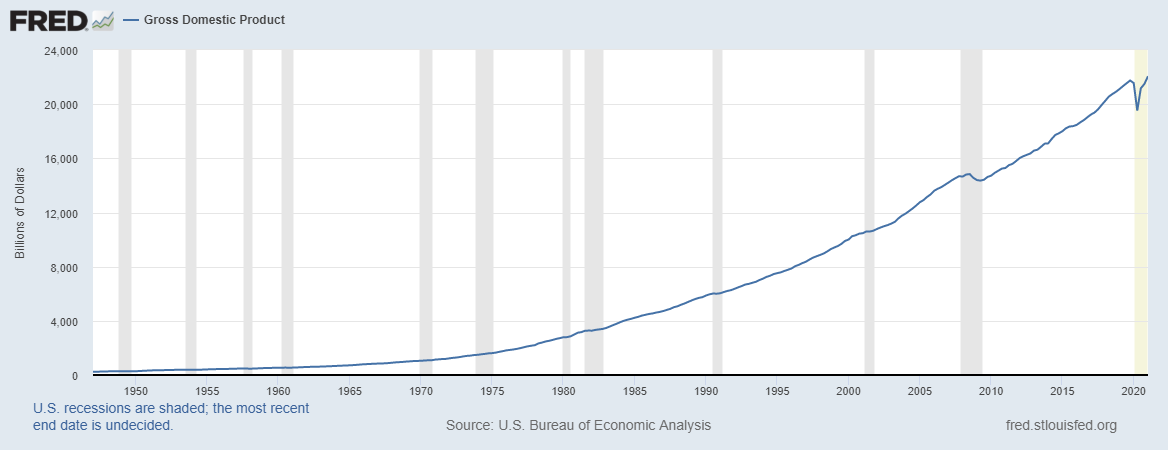

U.S GDP has continued to increase in a similar path to M2 money supply, is this because there is a money supply & credit demand equilibrium? Or is the excess over supply of U.S $’s indifferent to U.S GDP growth?

The answer to that question is illustrated in the velocity of M2 money stock, which confirms there is no supply demand equilibrium. The excess supply of U.S $’s does not correlate with equal growth in GDP., so where are the excess dollars going if not into main streets economy?

The principle intent behind the Federal Reserve quantitative easing (QE) program(s) is to purchase government and mortgage bonds to drive down interest rates. The consequences of this forces other market participants out of low yielding financial assets like bonds into riskier assets like equities in the search for yield and risk premium. So this is where the excess dollars are going, not into the real economy, but instead going into financial & capital markets to manipulate interest rates.

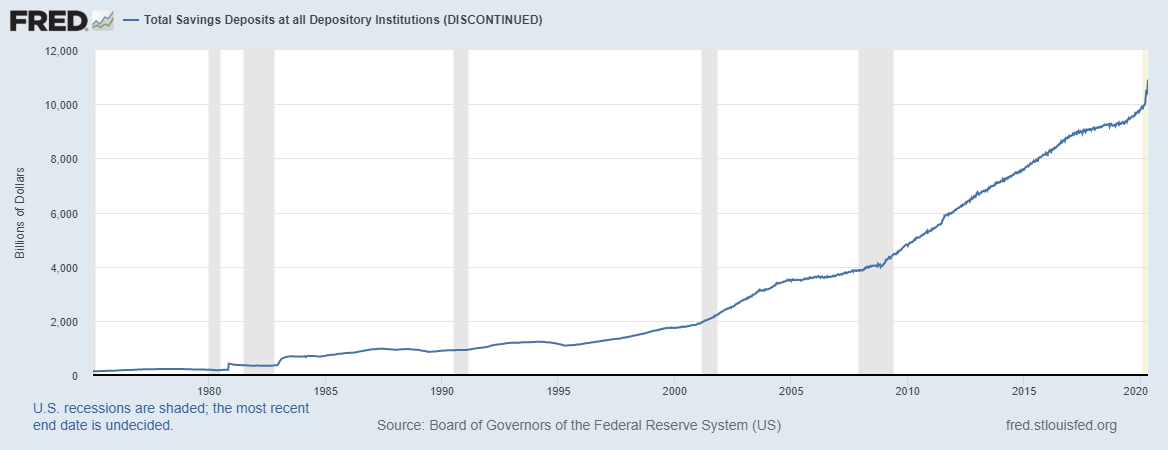

Low interest rates while favourable for borrowers are financially destructive for savers and those looking for fixed income on their financial assets. Current interest rates are at record lows in Western developed economies some even printing negative rates to lend to governments.

Will central banks ever reduce their balance sheets by withdrawing the excess liquidity and credit from the monetary system, if so, what are the consequences for markets?

Logic dictates that printing excess U.S dollars to oversupply the monetary system to reduce interest rates then reversing that financial engineering process would lead to an increase in interest rates. Ergo, central banks now have a serious problem in this period of record low interest rates. Record levels of debt has accrued meaning we now have unprecedented levels of debt, the consequences of raising the interest rates on this debt could be catastrophic for the economy and monetary system. Businesses would require to burn through more of its free cash flow to service the increase in interest payments while household disposable incomes would deplete too for the same reasons. So can central banks actually withdraw the excess liquidity from the monetary system without crashing the economy, many commentators believe they can’t. Furthermore having cognisance of this economic reality will central banks do it, or continue down the path of a perpetual QE program where the genie is out the bottle and never going back in. Where the financial & capital markets will be awash with an oversupply of excess liquidity eroding the store of value theory presented by fiat currencies.

As previously mentioned low interest rates are financially destructive for savers and as we see from the chart there is a record level of savings yielding either little to zero return. Add to that the prospect for higher inflation due to the excess supply of $’s and record fiscal stimulus by governments across the world due to COVID-19 which essentially just erodes the value of each of those savers wealth & value while eroding their purchasing power year after year, making their savings accounts as anti-stores of value.

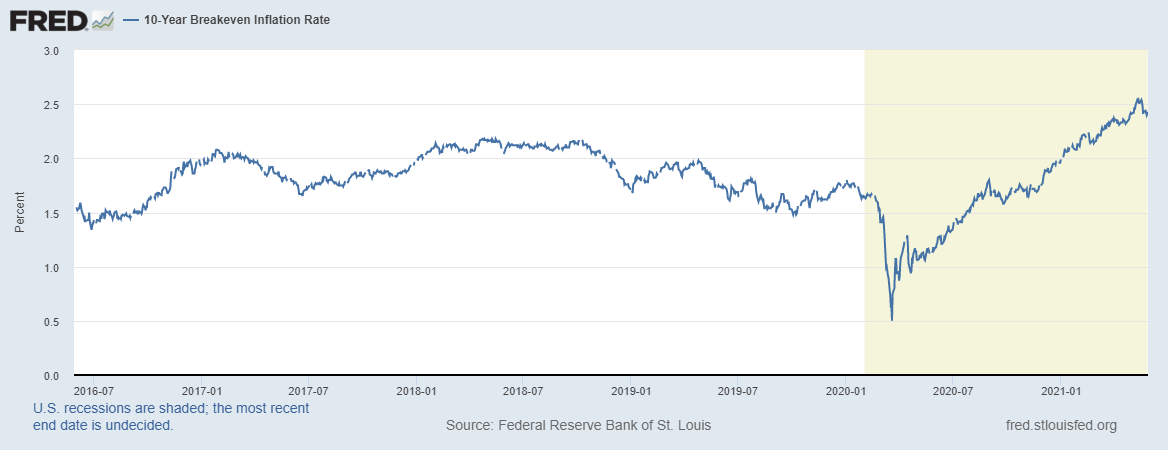

Inflation, inflation, inflation, the10 year break even chart confirms the markets believe inflation is coming also can the central bankers get it under control, if when it arrives. Or will inflation run away forcing central bankers to take reactive or drastic measures to attack inflation by forcibly withdrawing liquidity and increasing interest rates? Where does one go to hedge and protect value against the threat of inflation in this economic environment?

We clearly see commodity price indices are rising, are investors parking their capital here for a store of value, or is the price rise demand driven, or a combination of both?

How are equity markets reacting to the excess liquidity? Let’s look at the worlds largest most liquid equity index the S&P 500, it’s sitting at all time highs. In addition, its trading at record high P/E Ratios and risk premiums. What are the consequences on equity markets of a withdrawal of excess liquidity and interest rate rises? The consequences will be negative and could create the beginning of a bear market in equity prices. Where will investors go to protect value, what will be their instrument(s) for a store of value in that environment? When most traditional stores of value, are actually eroding value or at all time highs making the risk reward ratio not in favour. Add to this record levels of excess capital sloshing around the system looking for a store of value, it’s clear the current economic system requires more digital stores of value to absorb and protect this capital.

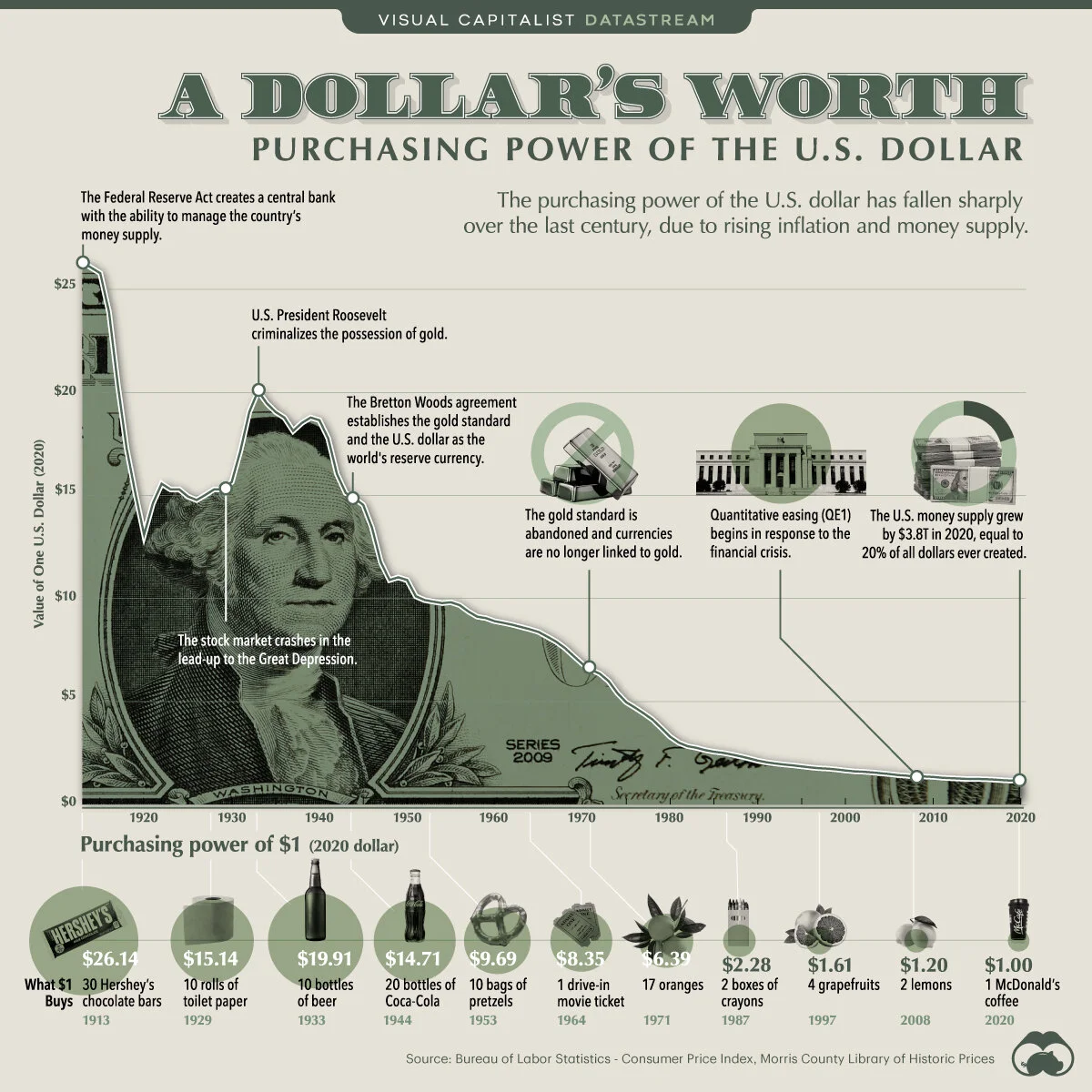

The U.S dollar and other fiat currencies are not stores of value this chart elegantly illustrates that reality and truth of the destruction of value and purchasing power. Fiat currencies haze no limit to the supply of their currencies from a centralised system, part of this value erosion is the lack of scarcity in the asset due to a shock to the supply demand equilibrium. It is clearly self evident the current economic environment needs more decentralised digital assets and stores of value like Reilly Coin.